Apple scores a benchmarkable path!

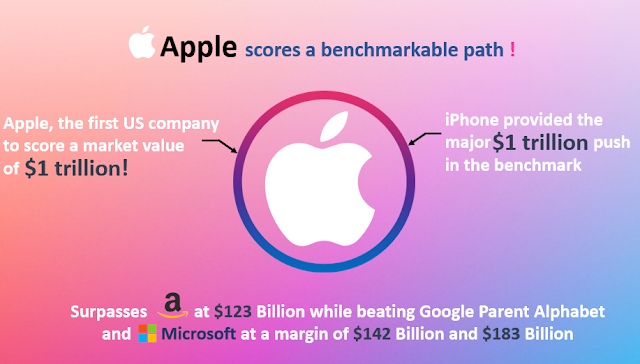

Apple! no, we aren't talking about the fruit rather the technological colossus of gadgets we all are aware of. The company has acquired new feathers to its cap by being the first US traded conglomerate achieving a market value of $1 trillion.

The news has been flooding all over the globe, with a humongous response from all its loyal stakeholders. Moreover, industry market research reports claim that it has been a leader in the stock market for around nine years after it overtook heads in the 1990s era of the stock market.

The Breakthrough!

Preferably, individually owned shareholders and part owners are rejoicing their previously owned money being quadrupled in the market zone. Market research claims the stock has been owned by millions of Americans using a system of funds in their 401(k), amounting to index funds including various other Apple Inc products.

Lawyers, teachers as well as upper-class salaried personnel are having a boost in their adrenaline with the news trending. Additionally, this claims that a conglomerate like Apple does take care of investors while achieving several innovative models equipped with world-class services

Inconsistencies

This does come with causalities. The success of a company is often followed by broad and diverge risks of stock market fallout. Accordingly, the case of Apple Inc. is also targeted by tariffs of bubbled interest rates as well as an economic fallout in the future.

Still, reliability is vast as compared to other billion-dollar companies in the market vicinity. Apple's recent achievement is notwithstanding any peak for the market trend and always has competitors on the line. Accordingly, with the news being trending on charts, its rivals would have similar peak strategies to develop for hitting the potential leader in a year or two.

Nevertheless, Apple's reaction on the same decides if it can have the spot for a bigger and vast conglomerate in the coming decade with its current $1 trillion profitability.

Similar trends

Not that a company hasn't achieved a similar breakthrough previously. Rather, a Chinese company called PetroChina had accounted for $1 trillion back in 2007 when it made a shocking debut in the stock market of Asia. Nevertheless, currency accounts for most profits around the world. With over the counter rise in the values of Dollar rates, it is undoubtedly the best time for US companies to hit the bullseye at large.

In the current menace, other US companies were similar to the conglomerate in achieving benchmarks. Conversely, the popular and employee friendly Amazon was amounting to around 877 billion Dollars, just pretty much close to what Apple.inc has achieved. Similar are the trends of Google Parent Alphabet and Microsoft owned by known leaderships, deeming to 858 and 817 billion dollars of shares in the market.

Apple, why?!

In the case of Apple, this has been led mostly by the highly reviewed iPhone, a benchmark of Apple's many digital products. Ordinarily used by millions of people in the world, the iPhone values for its stability and performance with adequate quality and reliability of the technology. All around the world, it is a widely used mobile phone brand for Facebook, call, messages as well as playing games.

The current S&P weighed by market value states that Apple tops the list as being the most valuable trader in the index by accounting a large impact of the pricing moves

• The company has acquired new feathers to its cap by being the first US traded conglomerate achieving a market value of $1 trillion.

• Market research claims the stock has been owned by millions of Americans using a system of funds in their 401(k), amounting to index funds including various other Apple Inc products.

• A Chinese company called PetroChina had accounted for $1 trillion back in 2007 when it made a shocking debut in the stock market of Asia

Category: Technology Market Research Reports

Contact Details:

Aarkstore Enterprise

Phone: +91 - 22 2756 4963

24/7 Online Support: +91 9987295242

Email: contact@aarkstore.com

Phone: +91 - 22 2756 4963

24/7 Online Support: +91 9987295242

Email: contact@aarkstore.com

Our website: https://www.aarkstore.com

Our blog: https://www.aarkstore.com/blog/

Comments

Post a Comment